Smart rings have been surging in popularity over recent years, a rise in people taking an interest in tracking their health is a major factor in the current market growth. We’ve recently seen major consumer brands such as Samsung enter the market releasing their Galaxy Ring, as discussed in my previous article, as well as smart ring focused brands such as Oura having sold over 2.5 million rings since their founding in 2013. More so, many new smart ring companies have been founded in the past couple of years alone, like Gloring, Yeyro, and RingConn.

What are Smart Rings?

Smart Rings typically consist of two different types, NFC based, and Bluetooth based:

- NFC Rings are fairly limited in function, as they typically feature little hardware, with most not including a battery. The most common use of NFC rings today is to replace your contactless payment methods, like Apple Pay, whilst other NFC rings on the market are designed to interact with other NFC products, such as door locks.

- Bluetooth Rings often feature various sensors and technology to record a user’s heartrate, steps, and more. They cater to people who don’t want to wear a bulky smart watch but still want to track insights on their health, especially when it comes to tracking your sleep. Also, nearly all Bluetooth smart rings have an app to accompany them for the user to view the data that the smart ring tracks.

Due to its limited hardware, NFC smart rings are often much cheaper in price compared to Bluetooth smart rings. Ranging from as little as $10 to upwards of $120, whereas Bluetooth smart rings retail for upwards of $400.

Smart Ring Technology and Growth

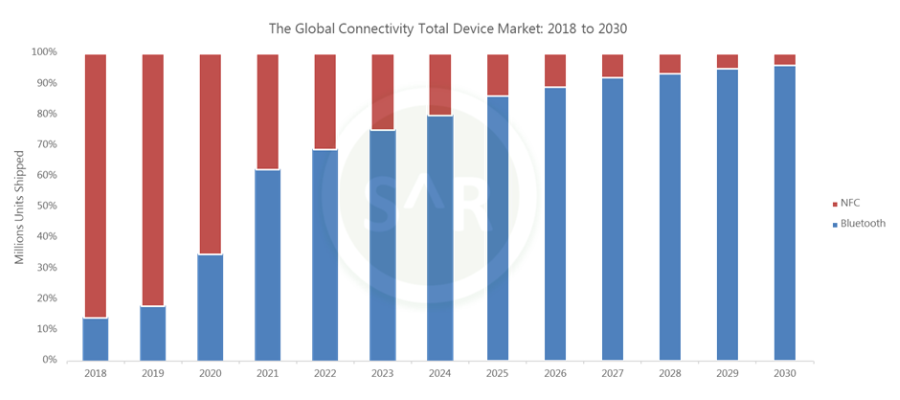

As mentioned above, the smart ring market is split between NFC rings and Bluetooth rings. NFC rings were first to hit the market after McLEAR’s release of the NFC Ring in 2013, and therefore 100% of the market were NFC rings at the time. Not long after, in 2015, Oura entered the market, releasing the first Bluetooth smart ring.

Oura’s ring was a huge success and with the decline in demand for NFC smart rings, Bluetooth overtook in shipments in 2021. Other competitors like boAt, Ultrahuman, and Circular entering the market with their own iterations is also a factor in the rapid growth of Bluetooth smart rings. We also see a lack of NFC in almost all of the Bluetooth rings in today’s market.

It’s clear that Bluetooth smart rings are on a steady rise to become the next big product within the wearable technology scene. RingConn, for example, recently started crowdfunding for their next generation smart ring earlier this month on Kickstarter and by mid-August 2024 have raised $2.5M from over 10,000 backers, indicating a keen interest from consumers towards the market.

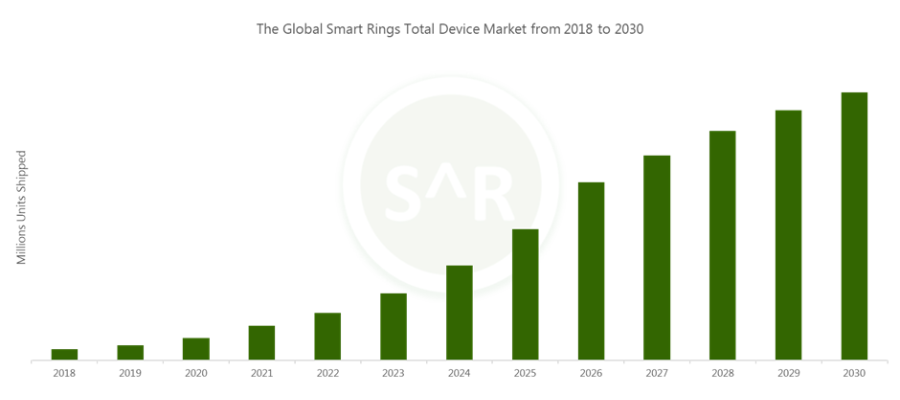

SAR predicts that annual smart ring shipments will be in the several millions by 2026, and it’s likely that this number will continue to grow as more companies enter the scene. While this pails into insignificance against a market such as TWS earbuds, it still represents a significant revenue stream for vendors of Bluetooth SoCs and sensors.

This article is extracted from a report prepared by SAR Insight & Consulting covering the Smart Rings market, the report provides a detailed review of the market trends, players in the industry, and analysis of the market size and forecasts. More details can be found here.